India’s wine industry is a young one, compared to Old World countries who have been making wine for centuries. Despite cultural issues, high taxation, and innumerable functional issues, the interest in wine in India is growing. If the forces were correctly aligned, there would be a remarkable surge, say reports

For years, when it comes to talking about the race for development in wine, India’s name has been juxtaposed with China’s. Even though China had surged well ahead, becoming a global powerhouse when it came to buying wine, wooed aggressively by Bordeaux and Burgundy leading the rest of the world.

Whither India? Mired in a stringent tax regime which has consistently confounded importers and producers alike, India, its potential yet untapped, has struggled to get a mention among top Asian wine-drinking countries.

A couple of months ago, while researching my global business exam topic for my WSET Diploma, I came across an interesting paragraph in the report by the IWSR, the global alcohol research organization. In their report, they listed the top 10 developing countries of the world which were the fastest-growing markets for alcohol as predicted for the period 2018-2023. Topping the list, which also included Mexico, Philippines, and Vietnam, was India. The reason quoted was, “A combination of growing legal-drinking-age populations and healthy economies is driving some of this growth, which is expected to continue over the next five years.” (Whisky grew by 10.5% in India, as consumers continue to trade up in the category, IWSR added.)

The writing is on the wall. The changes in consumer behaviour, the trend towards premiumization and rapidly-changing ways of social interaction are impacting the global beverage alcohol industry. India is no exception.

Image: Kelsey Knight/Unsplash. Main image: Scott Warman

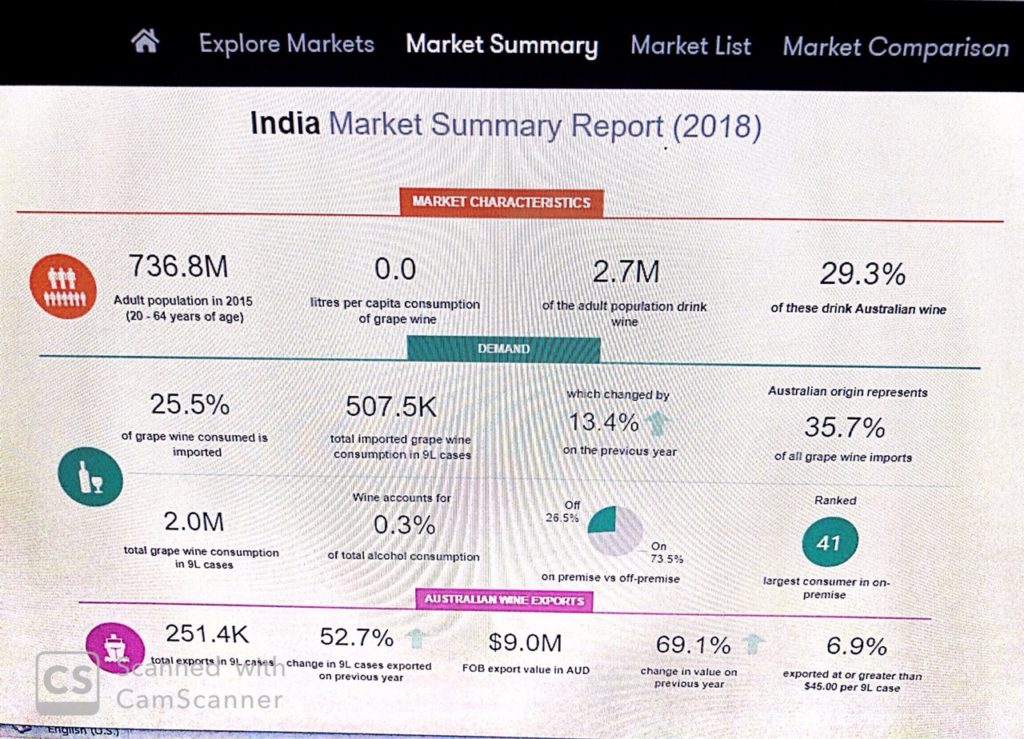

A couple of days ago, another interesting report popped up in my inbox. Wine Australia (the Australian government authority that promotes and administers its wine industry) in its market bulletin report, focused on the wine market in BRIC* countries. According to the 2017 World Bank’s report, these economies accounted for more than 41 percent of the world’s population by 2017. (To understand the work Wine Australia does, read this.)

In this post, I shall focus on the India findings from this report (India is referred to as ‘new emerging’, where ‘wine is still a relatively new and unknown beverage but showing potential’ in the report by Wine Intelligence). The report refers back to India’s long history in viticulture, dating back to the Bronze Age’s Indus Valley Civilization, and also the fact that it has the youngest population globally more than 19 million new potential consumers reach legal drinking age annually). That is a huge demographic and explains why, despite those crippling taxes on alcohol, wine, and spirits, producers across the world are so enthusiastic to be present in the Indian market. However, it does not take into consideration the fact that rural consumers are unlikely to get exposed to wine. The growth stems from the urban middle class.

A few additional outtakes from the report, below. Good to bear in mind that it is by Wine Australia, and reflects their POV. However, the comments and the figures on the BRIC countries are interesting (directly quoted below).

- Current per capita consumption of grape wine (2018) stands at only 200ml – one glass – this figure has doubled since 2010 and needs to be considered in the context of India’s total population of 1.35 billion. With a current ‘share of throat’ of 0.3 percent, wine is increasing in popularity with 73.6 percent consumed on-premise.

- Australian imports into India, while dominant in volume terms (35.7 percent of total), currently rank second after France in terms of value. Within the next year, Australian imports are forecast to overtake France, with projections indicating that between 2020 and 2023 the value of Australian wine imports growth, at 36 percent, will outpace French growth (11 percent) more than three-fold.

- In 2018, 6 percent of Australian imports (to India, by value) were classified as premium; this figure is forecast by IWSR to decline gradually to 4 percent over the next 5 years. With Italian imports volume expected to grow by 29 per cent between 2020 and 2023, and those from Chile forecast to be up 27 per cent (same period), it is likely that there will be increasing competition in the entry-level segment going forward as concerted efforts are made by other producers to penetrate the Indian market.

Another interesting observation. And though India’s imported wine volume is still very small compared to Russia and Brazil, it is growing at a steady pace. According to Vishal Kadakia of leading importer Wine Park, “The share of imported wine in India has been fluctuating between 350,000 cases to 475,000 cases from 2010 to 2018. However, if you add Indian wines, the same may hold true as they are growing much faster.” This is driven by Indian consumers, especially millennials and Generation Z who, attracted by the improving image of Indian wine and are looking for variety and healthy choices.

Wine Australia: India Market Summary 2018

- Shiraz (and its blends) dominates (Australian) exports to Brazil, Russia and India and the predominant white variety in all three markets is Chardonnay. Of the three markets under consideration, India is the largest and has the narrowest range of Australian wine label claims – just four varieties (and their blends) comprise 95 percent of export value. Sixty-eight percent of Australian exports are red, with Shiraz and Cabernet Sauvignon joined by Merlot (7 percent). Chardonnay (28 percent) represents twice the share it has in Brazil and Russia.

This references the mega-sized Australian producers (for example, Jacob’s Creek) currently dominating the Indian import market. However, with Australian wine developing cutting-edge technology, and experimenting with grape varieties and techniques with solid support from its own government, Australia is hoping to expand on the current scenario. Kadakia agrees, “33-35% of imported wines sold in India are from Australia.”

- IWSR forecast that from 2018–2023 the total value of wine consumed in India will increase by 55 percent (in line with volume growth predictions). According to Wine Intelligence’s India Report (2018), 56 percent of India’s wine-drinking population is under the age of 35.

This never-ending quest for cashing in on the preferences and wallets of well-travelled Indian millennials also creates great enthusiasm among international wine producers. I’ve lost count of the numbers of them who have told me they are standing by, waiting for the big ‘boom’ to happen in India à la China. Meanwhile, those with deep insights and deeper pockets continue to brave the red tape, tax, and stress of doing business here. “The wine industry is expected to see a 15% year on year,” says Kadakia. Will it jump further in the next few years? Time will tell.

- The tariff on wine imports in India is currently at 150 percent.

This is not the whole picture. Add to this state taxes, which drive up price points steeply. This is a sad reality for all enthusiastic Indian wine consumers who continue to pay inflated prices for wines. “If these are reduced, we can see a cascading effect of wines becoming cheaper, more importers and increased wine consumption,” says Kadakia. Given the much-discussed health benefits of drinking wine over hard spirits, this is something to look forward to.

*The term ‘BRIC’ was originally coined in 2001 by Jim O’Neill of Goldman Sachs as an acronym for the four rapidly developing countries of Brazil, Russia, India, and China. These countries, he said, symbolised the shift in global economic power away from the developed G7 economies. (Wine Australia)